Correcting WET Assessment Periods already filed

Previously, Vinsight used to automatically re-assess prior periods for you, but this approach was found to be too rigid and prescriptive.

We have changed the process here to give you more control and understanding about why an Assessment might need changing and give you the choice about what to do about that (if anything).

You might come across a need to alter a Sales Order from the past that has already had it’s WET paid to the ATO. In this case, you can simply change the Sales Order to be correct, or change the WET settings on the Customer or Product.

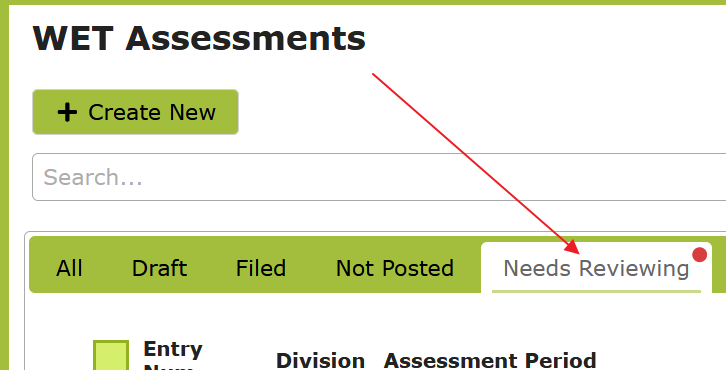

If a change to WET settings or an order might affect a prior WET Assessment that has already been Marked as Filed, the Assessment will now show up under the “Needs Reviewing” tab of your WET Assessments List. This includes if you change WET settings on a Contact, or create a new order for a period that has already been filed.

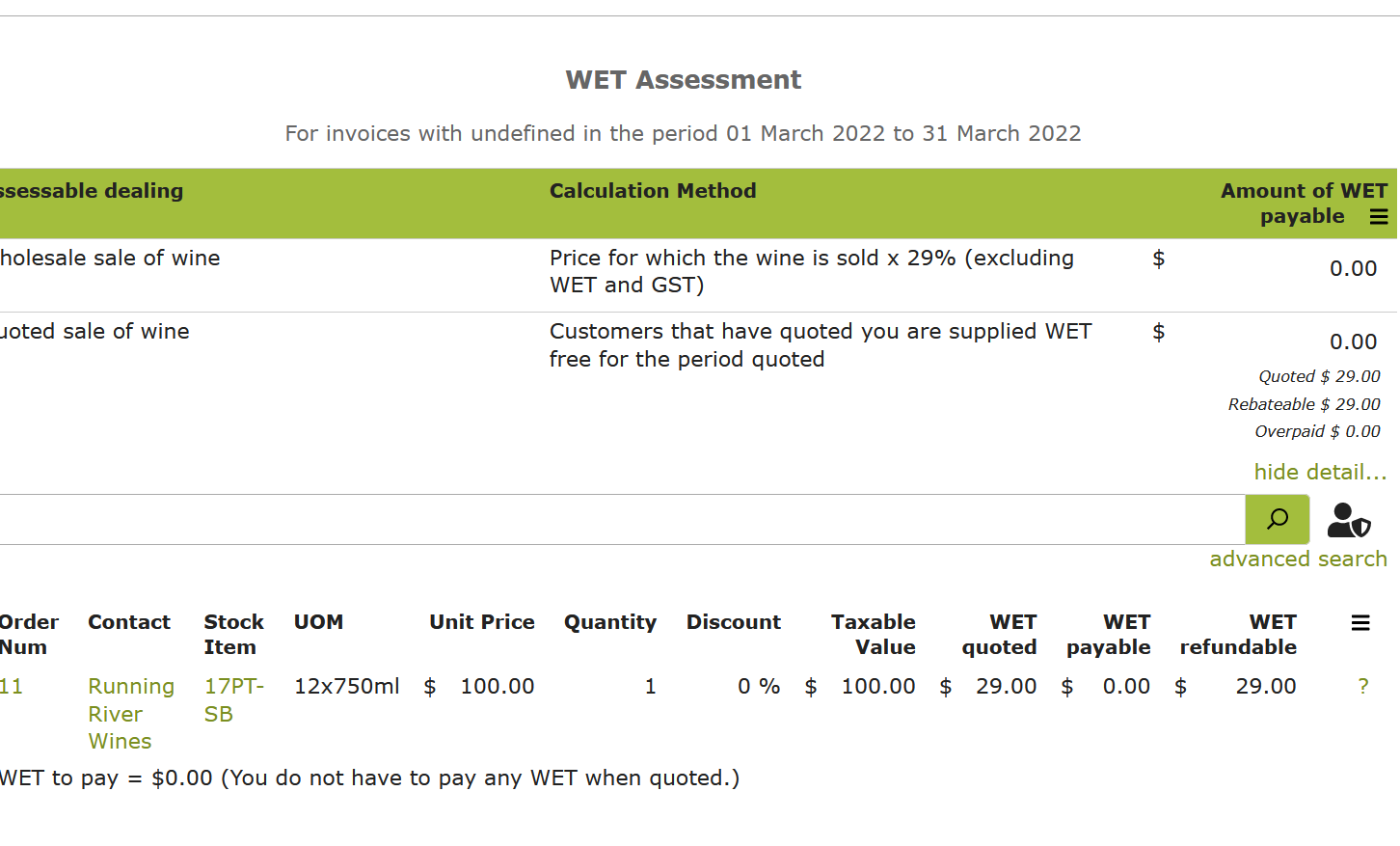

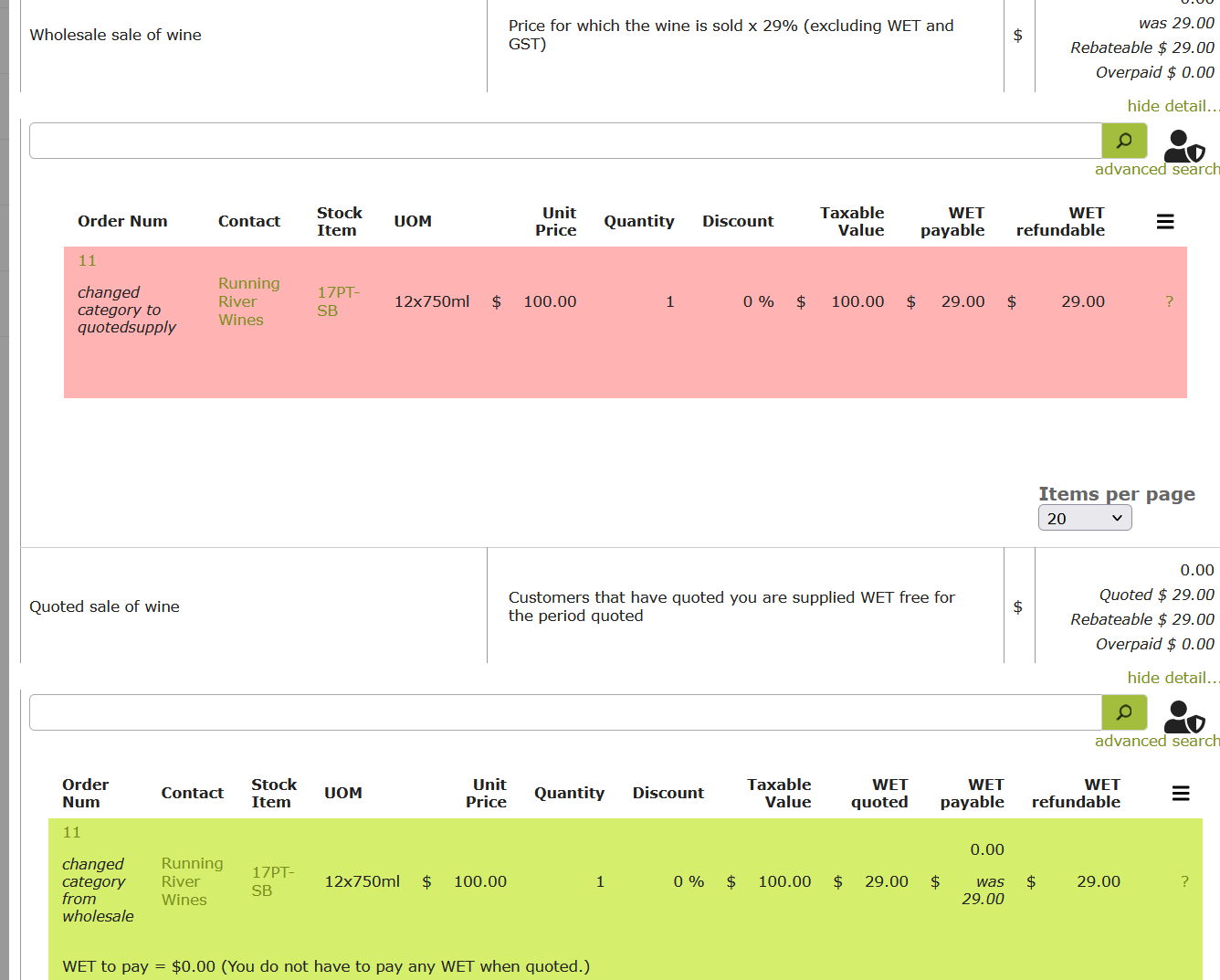

In the following example, we determined that we had incorrectly recorded a customer we sold to in the previous month, as having purchased using ‘Wholesale’, when they should actually have been recorded as ‘Quoted Supply’.

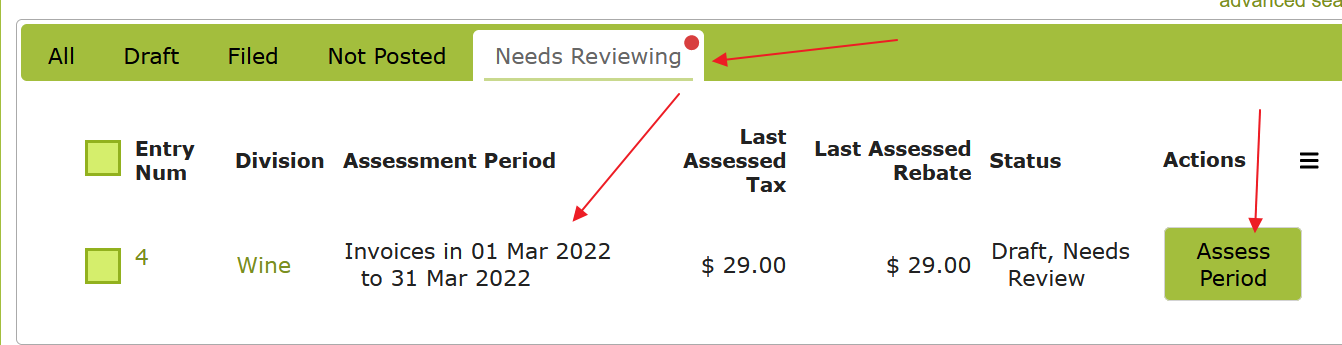

We corrected the customer’s attributes in “Contacts”. This change is picked up in the “Needs Reviewing” tab of the WET Assessment list. To review what changes have occured in this period, click the “Assess Period” button in this list.

Doing so will start a new assessment with the same settings as the assessment you want to assess against.

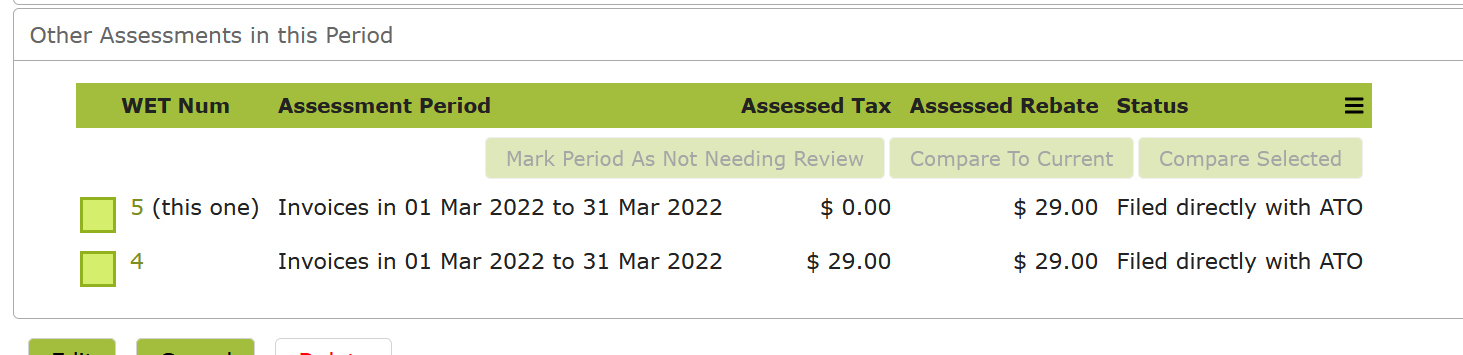

We can see on the new assessment that the WET liability has changed to “Quoted Supply”. But these sorts of changes can be hard to see if you don’t know what you are looking for. To double check this new assessment against the previously filed copy, you can scroll down to the “Other Assessments in this Period” section below:

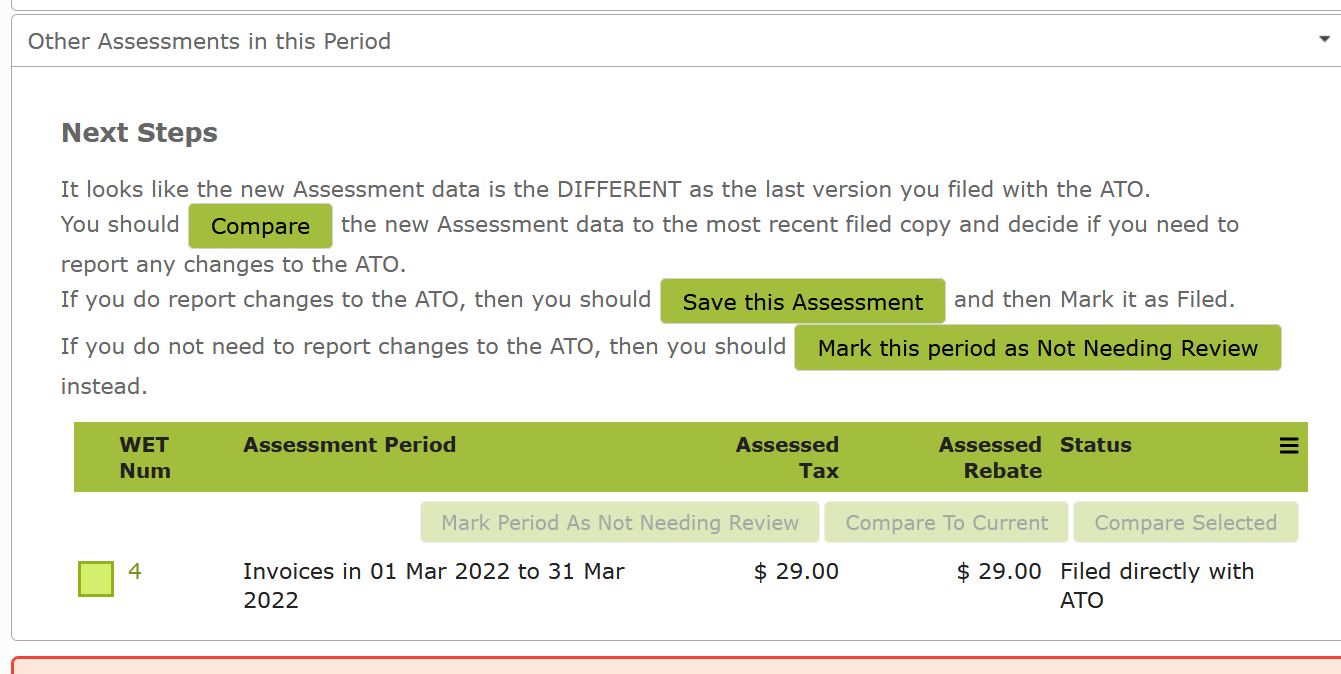

In this example, we have marked the previous assessment as being “Filed” with the ATO. Because we have done this, Vinsight is able to offer helpful suggestions as to what we might want to do with this new assessment information. It is up to you to review the information and decide if you want to follow Vinsight’s suggestions or not.

You can compare the new assessment data to any previously saved copy in the same period. If there are multiple assessments in this list, you can compare between any two saved copies as well.

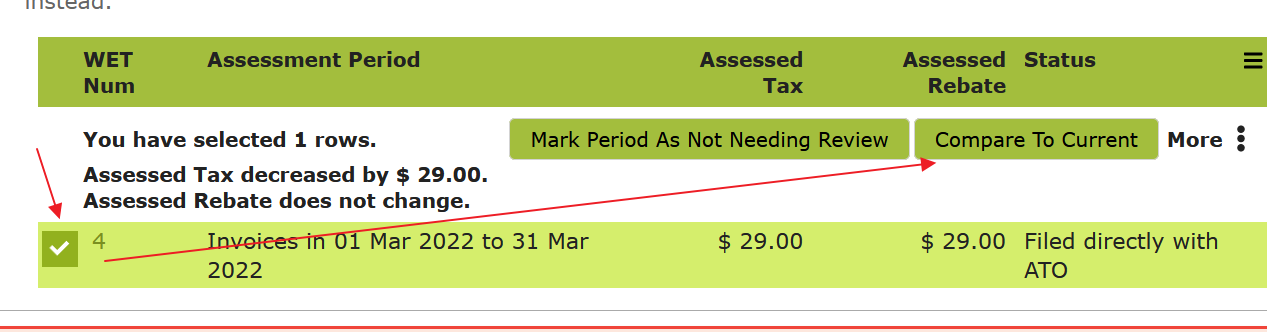

By comparing the two assessment copies, we can confirm that this order has indeed changed from “Wholesale” to “Quoted Supply” as we expected:

Now that we are happy with this new assessment and the changes it has made, we can save this assessment copy for future reference. If you plan to tell the ATO about the changes to this period, then you should mark the new assessment as “Filed”.

This includes if you decide to roll up any changes in to your next reporting month rather than telling the ATO specifically about this period. By marking the assessment as filed, this will help you keep track of what you need to tell the ATO should additional changes be required later on.

If you decide that any changes here are actually invalid or not important, you can chose to mark the period as “Not Needing Review” which will remove the previous assessment from the “Needs Reviewing” tab. It may show up again later if you change WET settings or orders in this period again.