Cost of Goods Delivered (COGD) Report

Overview

While many of our customers choose to journal their cost of goods at the invoice date, the ‘Cost of Goods Delivered Report’ gives you the option to journal these costs at the date of despatch instead. The report also provides a combined option, whereby you can account for all sales and deliveries within a period, using a ‘Sold, Not Yet Delivered’ liability account, (in addition to the ‘Asset’ and ‘Expense’ accounts used by the prior options) to journal and track the costs of goods within the period. Any of these journals can be imported to Xero.

This report is available to all customers on subscription levels that support product costing.

In this document:

Considerations When Choosing Options

Either ‘Cost of Goods Sold’ or ‘Cost of Goods Delivered’ are good options in terms of simplicity (provided you consistently use just one or the other), if you are only worried about having correct balances at the end of the year. However they do have some limitations.

If you choose ‘Cost of Goods Sold’, then you are possibly prematurely expensing undelivered items, so your inventory levels at any one time could be understated.

If you choose ‘Cost of Goods Delivered’, then you may be reporting your revenue and expenses in different periods so your ‘Profit and Loss’ Account might be slightly skewed between periods.

If you want to keep a running tally, one way to do it is at the end of each period, journal undelivered items to a liability account and expense the undelivered liability of previous period sales that you deliver within the current period. To do this choose the ‘Cost of Goods Sold or Delivered’ option.

Creating a Report

The Cost of Delivered Report is found in the Quick Reports on the Accounts Dashboard. Simply select any filter criteria for the items you wish to include in the report, as well as the date constraints. Read on for an explanation of the other options that are available:

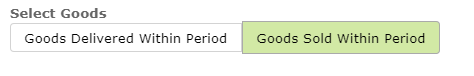

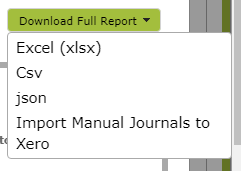

Select Goods:

As a default, the report will show you ‘Goods Delivered’ within the period selected.

Use the ‘Select Goods’ buttons to show either ‘Goods Sold’ . . .

. . . or all goods sold or delivered within the period instead.

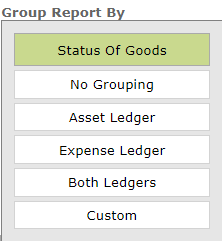

Group Report By:

As a default, the report will group by ‘status of goods’ which groups the line items into the following categories:

- Sold Prior, Delivered Within Period

- Sold and Delivered Within Period

- Sold Within Period, Delivered After

- Sold Within Period, Not Yet Delivered

The report can alternatively be grouped by ‘asset ledger’, ‘expense ledger’ or both as well as by a custom option, or have no grouping at all.

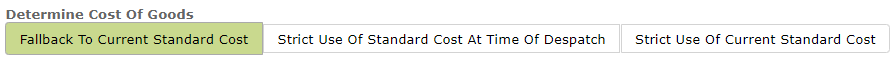

Determine Cost Of Goods:

The report runs off the ‘Standard Cost’ per unit value that is manually entered against each product in the ‘Costings’ area of each ‘Stock Item.’ (See Tracking/ Updating Standard Costs for information as to how to calculate an accurate ‘Standard Cost’ for each stock item.)

The ‘Strict use of Standard Cost at time of despatch’ option will use the Standard Cost set in the Stock Item at the time the product was despatched.

The ‘Fallback to current Standard Cost’ option will allow you to use the Standard Cost of that product at the time you run the report if the Standard Cost at the time of Despatch was zero (i.e. had not yet been recorded).

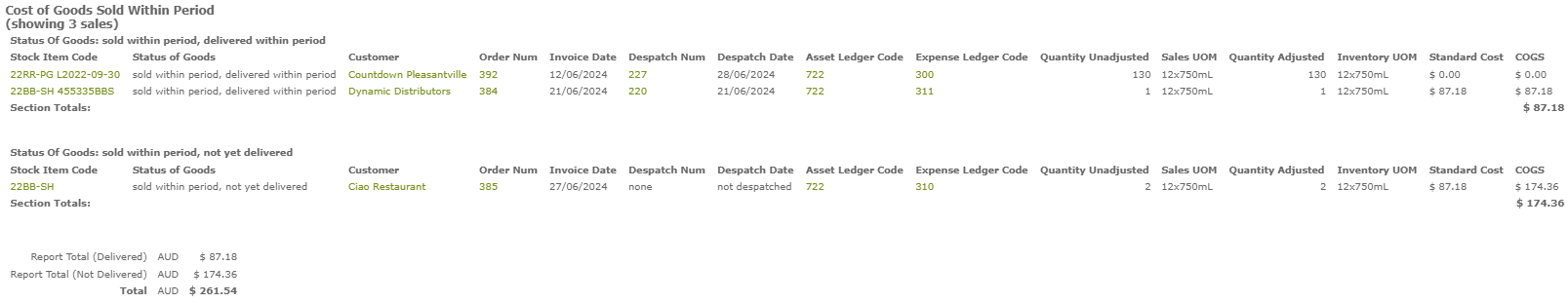

Using ‘Cost of Goods Sold’ Option

Using the ‘Cost of Goods Sold option means you journal the Cost of Goods at the invoice date. Providing you consistently use this option, this will produce perfectly acceptable accounts.

However it may less accurately reflect reality on the ground, as the goods in question (while ‘sold’) may still be sitting in your warehouse, meaning your inventory levels at any one time could be understated.

Please click on image below to view full size.

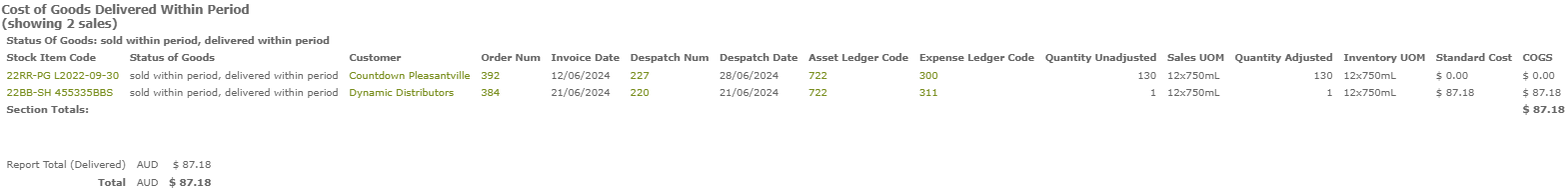

Using ‘Cost of Goods Delivered’ Option

This is the default option for the report. Using the ‘Cost of Goods Delivered Option means you journal the Cost of Goods at the delivery date. This means your accounts will more closely track the goods physically moving off your premises. Again, this will produce perfectly acceptable accounts, provided you consistently use this option. However, as noted above, you may be reporting your revenue and expenses in different periods so your ‘Profit and Loss’ Account might be slightly skewed between periods.

This report will detail all goods despatched within the period, whether sold prior or during the period in question.

Please click on image below to view full size.

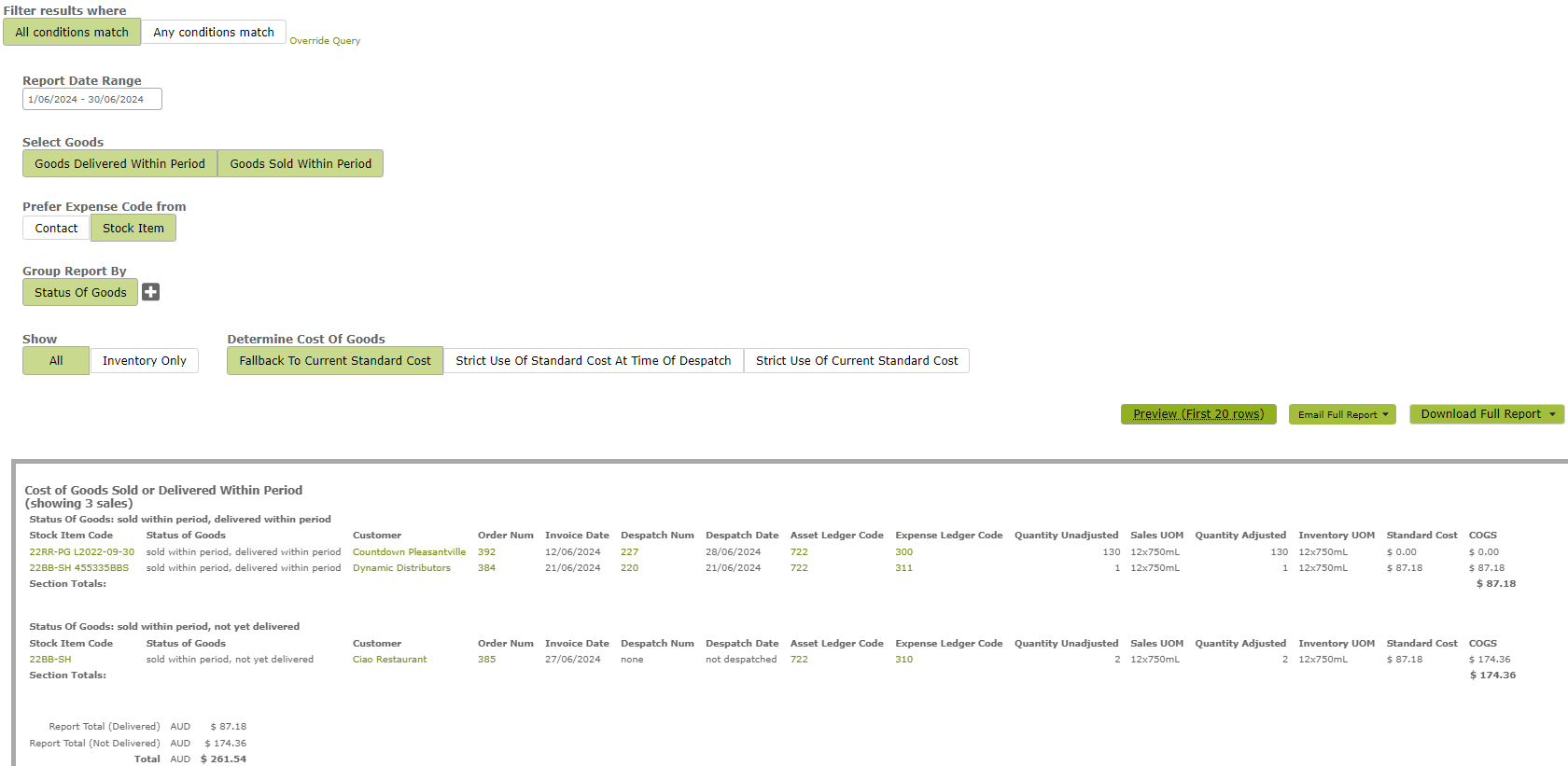

Using ‘Cost of Goods Sold or Delivered’ Option

This option will most accurately reflect the reality of what is happening in your business, as it incorporates all the sales and delivery detail. However, it is slightly more involved (and may provide more detail than your are after!) To use this option, you will need to set up an ‘Sold, Not Yet Delivered’ liability account in Xero (or whatever accounting system your use) as well as the Asset and Expense one.

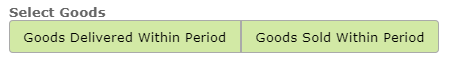

In addition, if using Xero, you will need to select the checkbox next to “Should Vinsight journal undelivered sales?” and add the relevant liability account number.

The resulting Cost of Goods Sold or Delivered report will look something like this. Please click on image below to view full size.

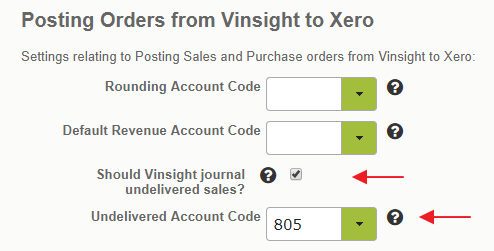

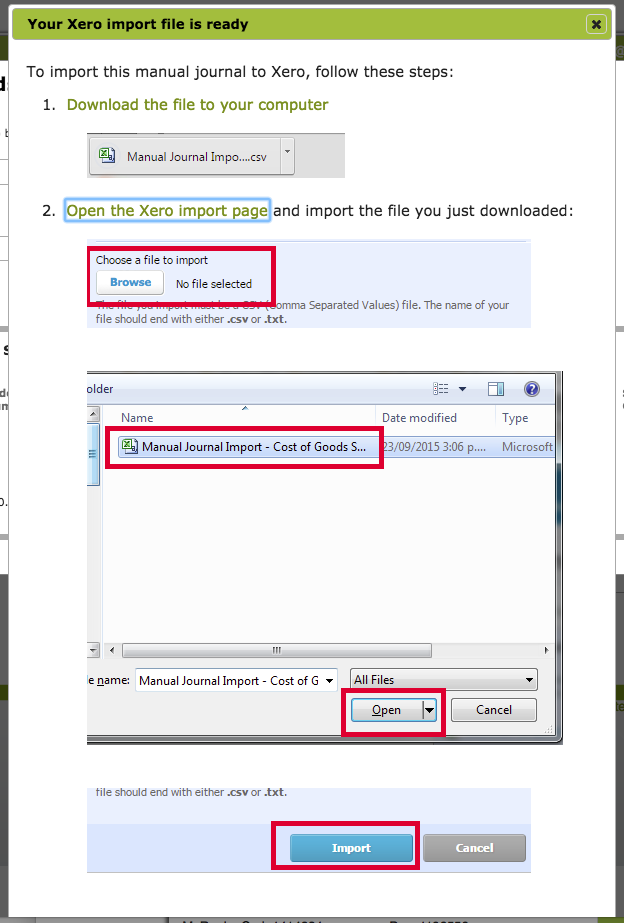

Once created you have the option of emailing the report, downloading it, or importing it to Xero. To import to Xero, click ‘Import Manual Journals to Xero’ on the Download button drop-down list and follow the instructions set out there.

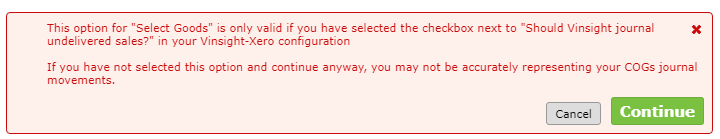

When using this option (i.e. have both “Goods Delivered Within Period” and “Goods Sold Within Period” selected, you will receive the following warning. This is to remind you that you will need to have an ‘Sold, Not Yet Delivered’ liability account set up in Xero, have selected ‘Should Journal Undelivered’ in your Vinsight-Xero configuration, and have recorded the relevant account there.

If you have completed this set up, click ‘Continue’ and following the Xero Import instructions. These instructions are set out below are set out below:

Frequently asked questions

Why does Vinsight not send Cost of Goods (COGs) journal movements with every sale?

We have made the process of sending COGs journals a manual process to be done at the end of a period for a few reasons:

- During the month, particularly for wines not yet bottled, you might not have the costs all worked out and assigned to each Stock Item yet.

- It minimises the number of journals that you need to send to Xero, making it easier to audit movements.

- It also allows you to audit the transactions before they are sent as a single journal movement, so mistakes are easier to catch and are not automated.