Allocating Labour Costs

Overview

Vinsight has no special labour handling, it is however easy to incorporate an already calculated labour cost to Grower Operations, Bulk Operations, Packaging Operations or as an indirect “overhead” using Component Allocations. While this document describes labour costs, you could use exactly the same approach for other costs, eg costs from contract processing, outsourced pruning, custom crush or contract bottling. Simply create Stock Items for each eg “Cost-Bottling Fees” etc.

Note: This is only relevant for subscriptions that have costing features.

In this document:

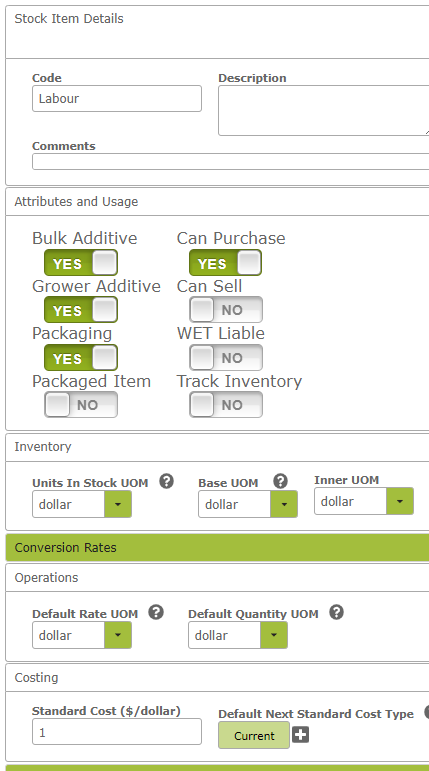

Creating a Stock Item for Costs like Labour

Create a stock item for your cost eg “Labour” or “Cost-Contract Processing”, for most flexibility, use a Unit of Measure like “dollar” and make the Standard Cost $1.00 or your local currency unit.

Set the Bulk Additive, Grower Additive and Packaging flags to ensure it shows on the right lists in the app.

The reason to use a unit like “dollar” (or Euro, Rand etc) rather than “hour” or similar is that this makes your cost allocation super flexible, eg if you have 3 different pay rates per hour, you still only need to apply one item for the total labour cost not 3 items with 3 different costs.

Accruing costs specific to Production

For expenses that are specific to production that you want to record against your production, you might create a simplified Stock Item like the Labour one above. The main difference is that you would write a purchase in Vinsight to record this. You might also consider splitting the purchase into several lines if you wanted to link or apply these to separate operations to make it easier to apply one line cost to one operation.

You might also consider creating one Stock Item Code to represent several similar costs.

for example things like:

- “Packaging Fees” for things like Artwork costs, Tooling costs, Setup Fees, Contract Canning or Bottling

- “Production Services” or “Processing Fees” for things like: Filtration, Contract Winemaking Fees or Third Party Brewing Fees

- or simply use specific ones like “Freight Expense” for specific jobs like bulk freight to the canning or botting facility

One other tip is that, during the month you receive these invoices or costs, then you “use them up” on operations. One way to easily see if you have exactly applied the same amount of costs that you received, is to make the Stock Item an inventory tracking item even though it is only a service. Why? This allows you to have a balance of “Packaging Fees” that increases during the month as you receive invoices from suppliers, then decreases as you use those fees on operation, so in theory, the balance of this item should be zero at the end of each month, and if it is not a zero balance then you can investigate what you have over or under allocated.

Accruing general business costs

Costs that are not specific to production, but you want to apply a specific share to an operation, eg an allowance for Labour or an estimate of fuel usage for a still run, then you may not have a specific purchase order for this item like Labour, so you might simply draw down the expense ledger that has already been increased in your account system though some other means eg your payroll.

In this case, you simply want to make sure that your Stock Item eg “Fuel” uses the asset or expense ledger that this item would have been sent to in your accounting system. For very general costs not specific to a particular job, you would do this through overheads using our Component Allocations feature.

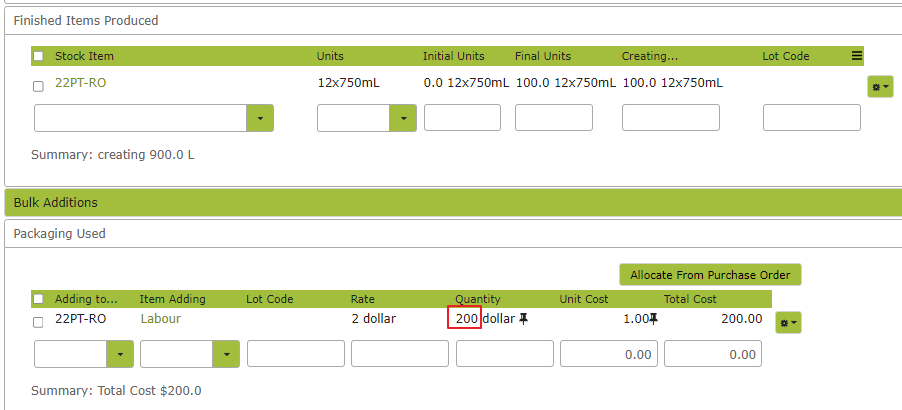

Applying costs to operations

Now once you complete operations and have used your other labour management tools to give you a total cost, enter this total as an additive on the operation. The “Quantity” is the only box you really need to edit, as the “price” should always already be $1, and $1 x Quantity should give you the correct total cost, i.e. entering one total quantity does everything you need.

eg:

This will show as a cost along side other additives like labels and ingredients etc.

You can do something similar for Grower Operations, Bulk Operations and Packaging Operations.

Notes on accounting:

Adding costs on operations will, through the end of month journals, remove cost from asset accounts like “bulk additives” or “packaging” and move it to the relevant current asset ledger like “Bulk WIP” (Work In Progress) or “Finished Items” etc.

However you need to have costs available to move if you do not want your source asset ledgers “overdrawn”. So what you can/should do is for services from other suppliers eg Contract Bottling companies, you would write a purchase order and code the Bottling Fees to your “packaging” current asset so the bottling operation and subsequent journals have money available to apply to the Finished Item.

For costs like Labour: in your wages system you might code certain activities so they get capitalised to a current asset account like “Wages to Capitalise” or similar. So these have balances to journal at the end of the month.

For more information on end of month journals and recommended chart of accounts, have a read here: End of Period Inventory Journals