Ledger Accounts (Chart of Accounts)

Overview

While Vinsight is not an accounting app, there are places that you can fill in Revenue, Expenses and Asset Ledger Code to make cost accounting features work and make posting to your accounting system more automated. These account codes are referred to as Ledger Accounts in Vinsight and collectively form what is often referred to as the Chart of Accounts in accounting systems.

You can create these manually, or you can copy these from your accounting system with the click of a link. Read below for more details.

In this document:

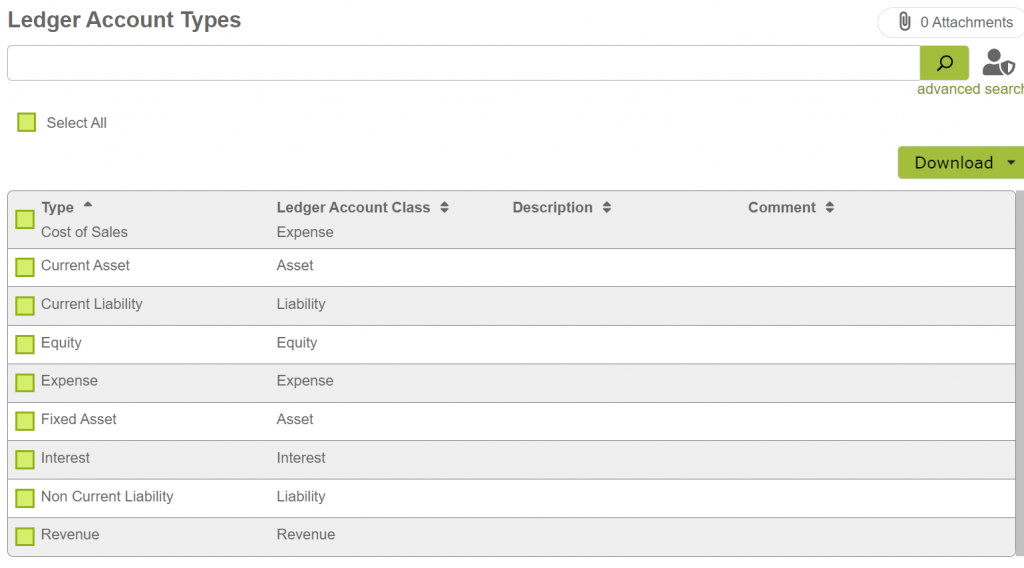

Ledger Account Types

You can maintain Ledger Accounts manually in the Settings > Accounts area.

Firstly Ledger Account Types as in the image below.

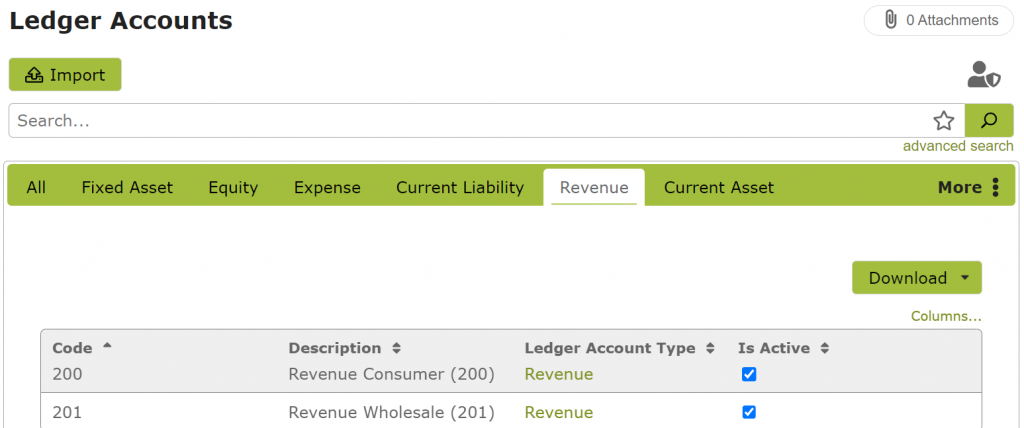

Ledger Accounts

Then you can create Ledger Accounts for each type.

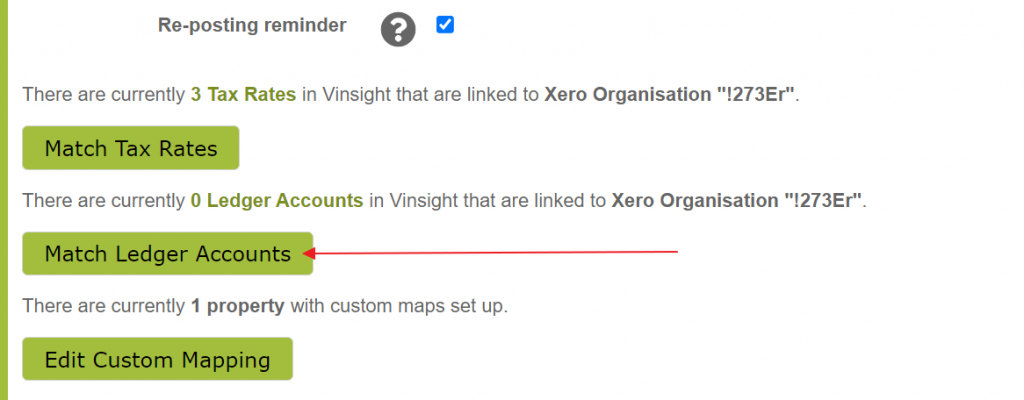

Copying Chart of Accounts from Xero

If you already have a Chart of Accounts defined, in say Xero, you can automatically copy these over from Settings > Setup > Addons > Xero:

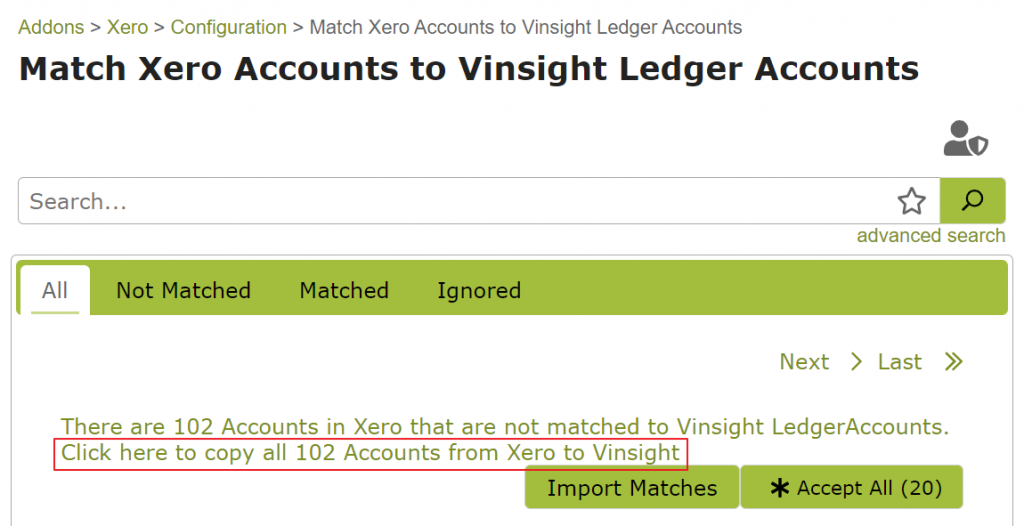

Then click the link below.

Recommended Chart of Accounts

- 821 WET (If you are in Australia and need to Track WET Tax)

- 822 Excise Duty (If you are paying Excise Duty for Beer, Wine or Spirits)

- Finished Items (For your items that are packaged and ready of sale)

- If using a Vinsight production subscription then add these as well:

- Grower Dry Goods (Dry goods purchased but not yet applied to the Vineyard or Orchard)

- Production Dry Goods (Ingredients purchased but not yet applied to Bulk Wine, Beer etc)

- Packaging Dry Goods (Packaging not yet used for bottling or kegging)

- Bulk WIP (All you bulk beer, wine or spirits that is in tank or barrel and not yet packaged)

- Costs to Be Capitalised2 (Holding account for indirect costs to be capitalised as overheads)

- Three to four Revenue Ledgers to represent high level revenue performance. For example. . .

- Sales Wholesale

- Sales Direct to Consumer

- Sales Export

- Cost of Goods Sold