End of Period WET Tax tasks

Overview

Vinsight enables you to produce end of period, comprehensive, auditable WET summaries, showing the total WET tax (including wholesale, retail and own use tax), you owe or are owed from the ATO, with respect to all Sales Orders created in the App.

However there are some tasks that you should do at the end of each period to make sure your figures are correct and that this data gets accurately reflected in your accounting system.

In this document:

Run and save your WET Assessment

Many of the WET Tax types can only be optimised at the end of the period by referencing other sales within the period to calculate their minimum allowable taxable value. This means you must run a WET Assessment at the end of each period to do these calculations. Once you have verified the sales in each category (see the next section), you should save a copy of the assessment data for future reference and auditing using the “Save Assessment” button at the bottom of the assessment before your file with the ATO.

Verify Tax Categorisation

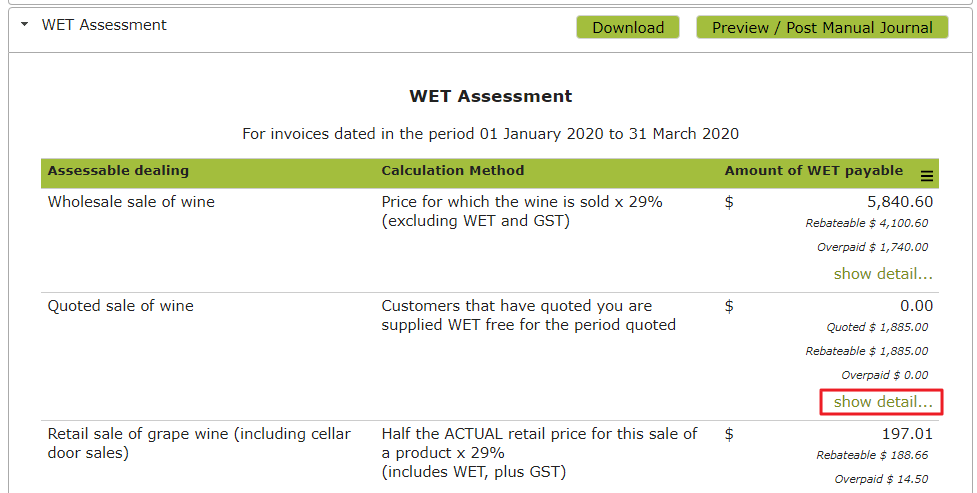

Before saving and filing your WET on your BAS, you should spend a little time checking the data that makes up the totals by drilling into the different sections and sense checking them, you can use the “show detail…” link to see the orders that make up the totals:

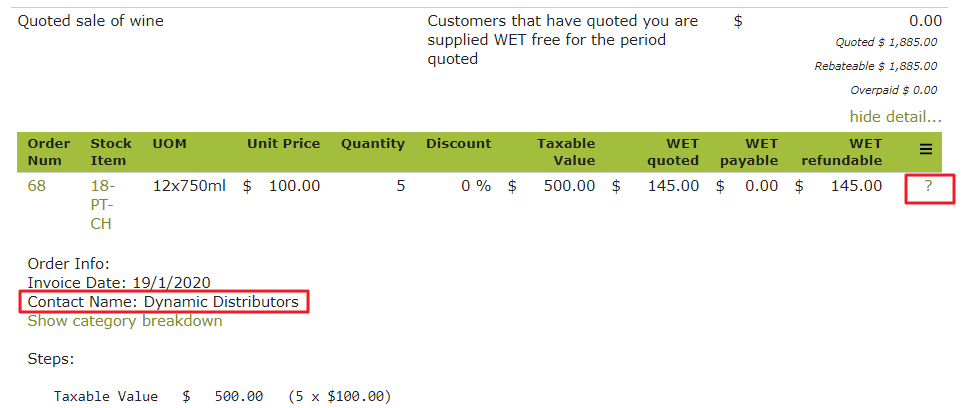

Then each order line, you can click the “?” to see details about the customer and the tax calculation, for example below it seems reasonable to imagine a distributor might be in the “Quoted sale of wine” section rather than the “Wholesale sale of wine”:

If a an order appears in the wrong section, you can go the Contacts list, then edit the details of the customer to fix it, and re-run the assessment, before finally saving it.

Once you are happy with the data and amounts, you must save it.

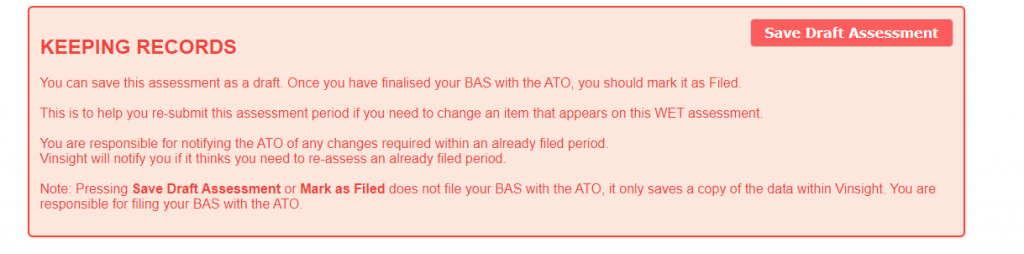

You can save the assessment as a draft. Once you have finalised your BAS with the ATO, you should come back mark it as Filed.

This is to help you re-submit this assessment period if you need to change an item that appears on this WET assessment.

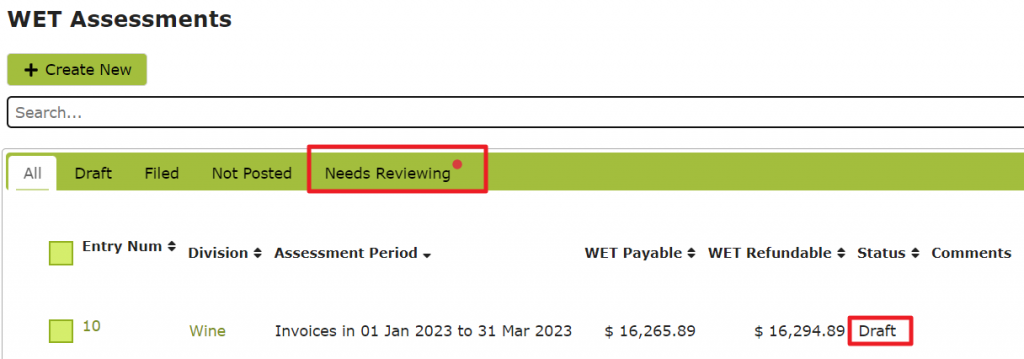

A save assessment will show as a draft and on your “Needs Reviewing” tab:

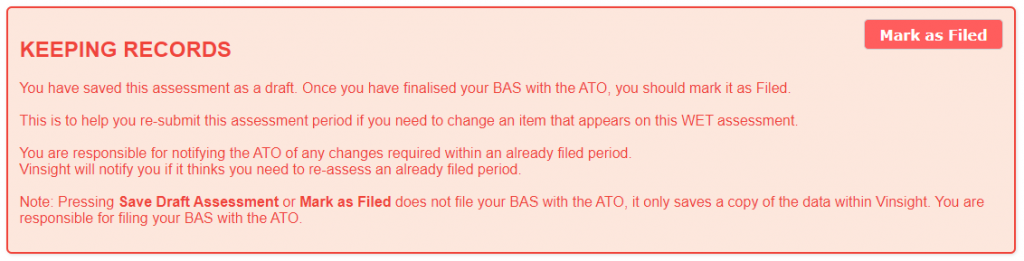

Once you have filed your BAS using the figures from this Assessment you should come back and mark the assessment as having been filed. This is so that if you get audited or make any changes, it is easy to know what you have told the ATO and if you need to advise them of any changes. You do this by marking the assessment as filed:

You are responsible for notifying the ATO of any changes required within an already filed period.

Vinsight will notify you if it thinks you need to re-assess an already filed period.

Note: Pressing Save Draft Assessment or Mark as Filed does not file your BAS with the ATO, it only saves a copy of the data within Vinsight. You are responsible for filing your BAS with the ATO.

Posting data to your accounting system

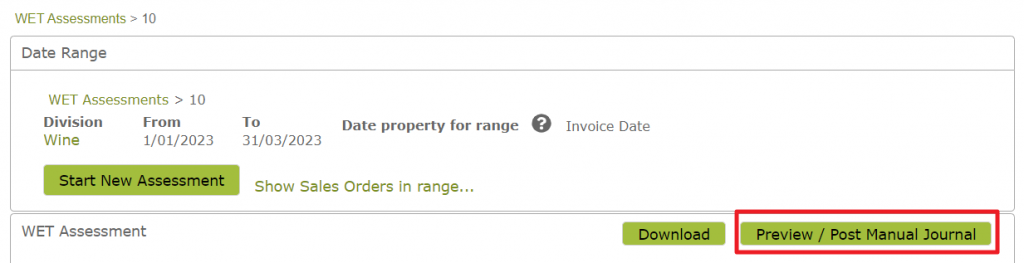

Finally and importantly for your accounting accuracy, you should post the assessment as a journal to reflect any adjustments and optimisations that the assessment made.

Clearing your WET Payable liability account using an Accounts Payable Invoice

- Each wholesale invoice that you posted during the period will have already coded amounts to the Revenue, GST and WET Liability account each time a wholesale invoice is coded. Let’s say we send $1000 of wholesale WET during the period this will be in the WET Liability account as $1000.

- At the end of the period, you *must* run and post the WET Assessment. This will journal any extra WET Liability from either WET Own Use (eg samples) or retail sales that have been tax optimized. eg if you have $200 of extra liability this will increase the WET Liability account from $1000 to $1200.

- The WET Assessment would show the amount of $1200 as your WET Payable (box 1C on your BAS)

- You should raise a Payable Invoice in Xero to the ATO for $1200 coded to the WET Liability account. This will clear the $1200 out of the WET Liability account and move it to accounts payable. (the balance in your WET Liability account at the end of the month should be $0 for invoice based BAS reporting, or the value of WET on unpaid wholesale invoices for cash based BAS reporting)

Reflecting your WET Refundable from Rebate or Overpayment using an Accounts Receivable Invoice

- At the end of the period, you run the WET Assessment. At the bottom will be a WET Refundable amount that you transfer to box 1D on your BAS. Let’s imagine this is $1500.

- You could raise a Receivable Invoice in your accounting system to the ATO for $1500 coded to a Revenue account eg WET Rebate.

Contra the payable against the receivable

- Process a payment against the Payable Invoice to the ATO *from* a contra account. eg $1200

- Process a payment against the Receivable Invoice to the ATO *to* the contra account i.e $1200. The contra account should now be a $0 balance.

- When you see a payment for the balance between $1500-$1200=$300 hit your bank account, finish paying the Receivable Invoice to close it.