Setting up value based taxes

Overview

As well as dealing with Sales Taxes like GST, VAT and HST that are percentage based, Vinsight can also record and show taxes on invoices that are value or quantity based such as Bottle Deposits or Alcohol Taxes.

NB: Do not use this feature for Excise Duty or Wine Equalisation Tax (WET) as there are dedicated features and reporting for these, see Excise Duty Assessments and Calculating WET Tax with Vinsight.

In this document:

Container Deposit Scheme example

If you need to add a per unit charge to your invoices for things like a Container Deposit scheme, you can do this using the following setup as an example.

Setting up a Container Deposit charge.

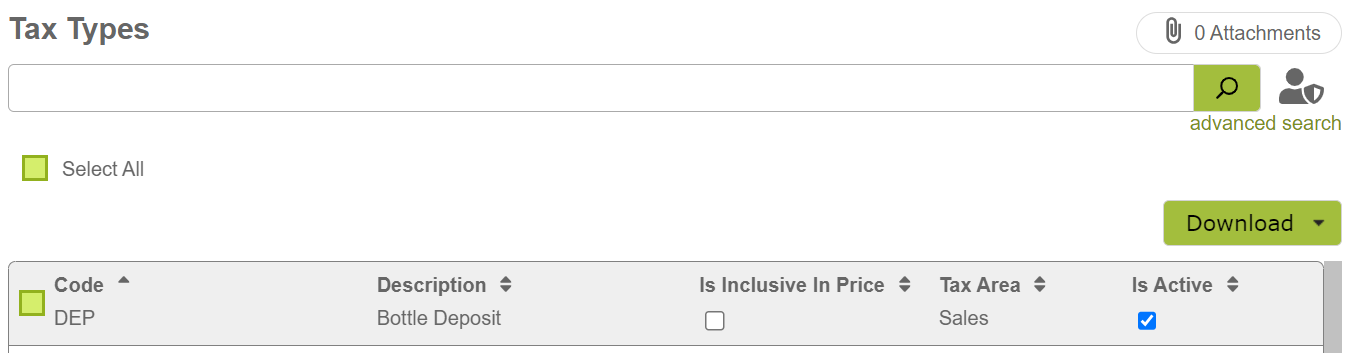

Set up a Tax Type using the settings below as a guide:

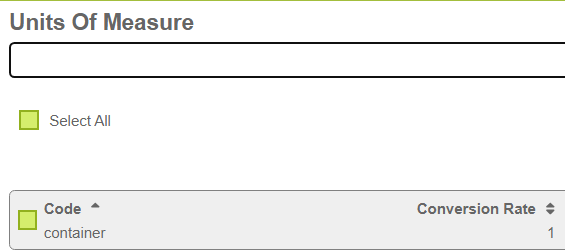

Set up the units of measure that you need for the containers. If all containers are treated equally then you may only need one “container”. If containers of different sizes have different values you may need to create multiple units of measure, one for each size needed, or you may be able to use your existing sizes.

Set the conversion rate to “1” as you will need to set this to a correct value in each Stock Item that is liable for the charge.

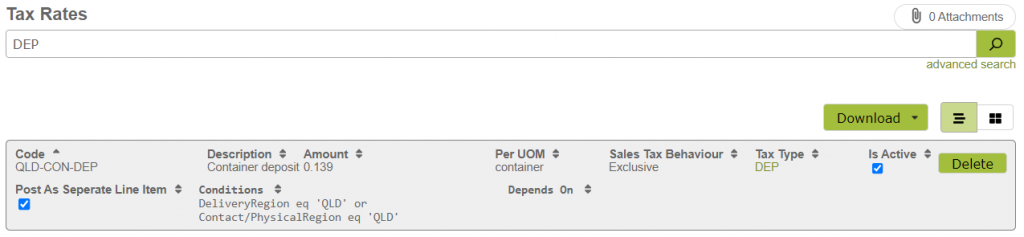

For each tier or container tax cost, create a Tax Rate to reflect this. The example below is 13.9 cents per “container” and the 13.9 cents is excluding GST/Sales Tax, so any sales tax will be added to the 13.9 cents.

Also note that this fee/tax only applies when the Contact’s Physical Region (eg the Customer’s State) or the Order’s Delivery Region is equal to “QLD”

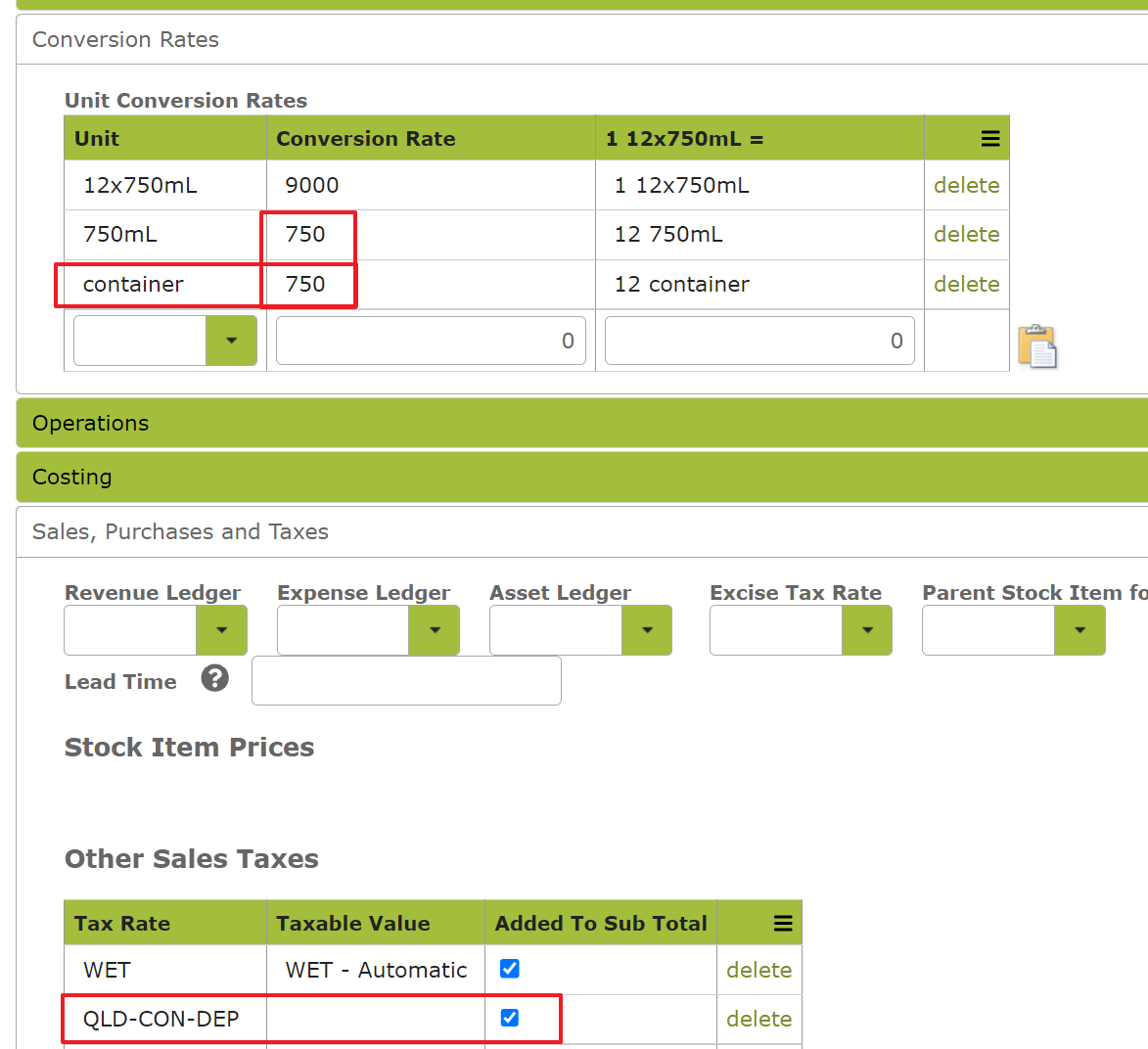

Now for each Stock Item that you want this tax/fee to apply to, you need to set 2 things:

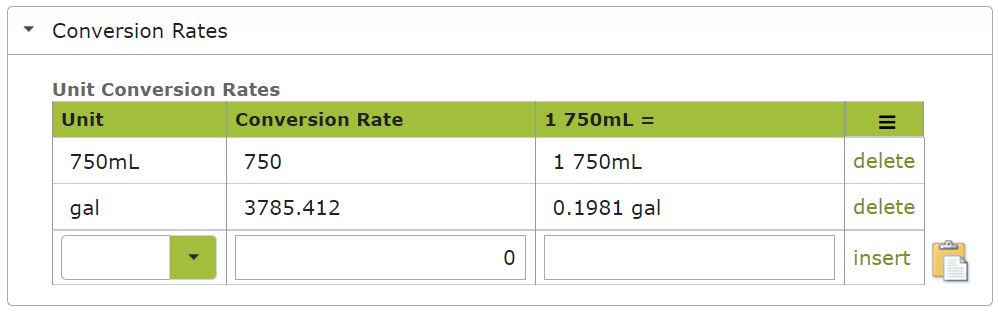

a) the conversion rate, you need to add container, and *make sure you edit the number to match the bottle size* in the example below the Unit “750mL” is considered the “container” so you must make the “container” unit use the conversion of 750.

b) add the Container tax to the “Other Sales Taxes” section. Click “insert” then save the Stock Item.

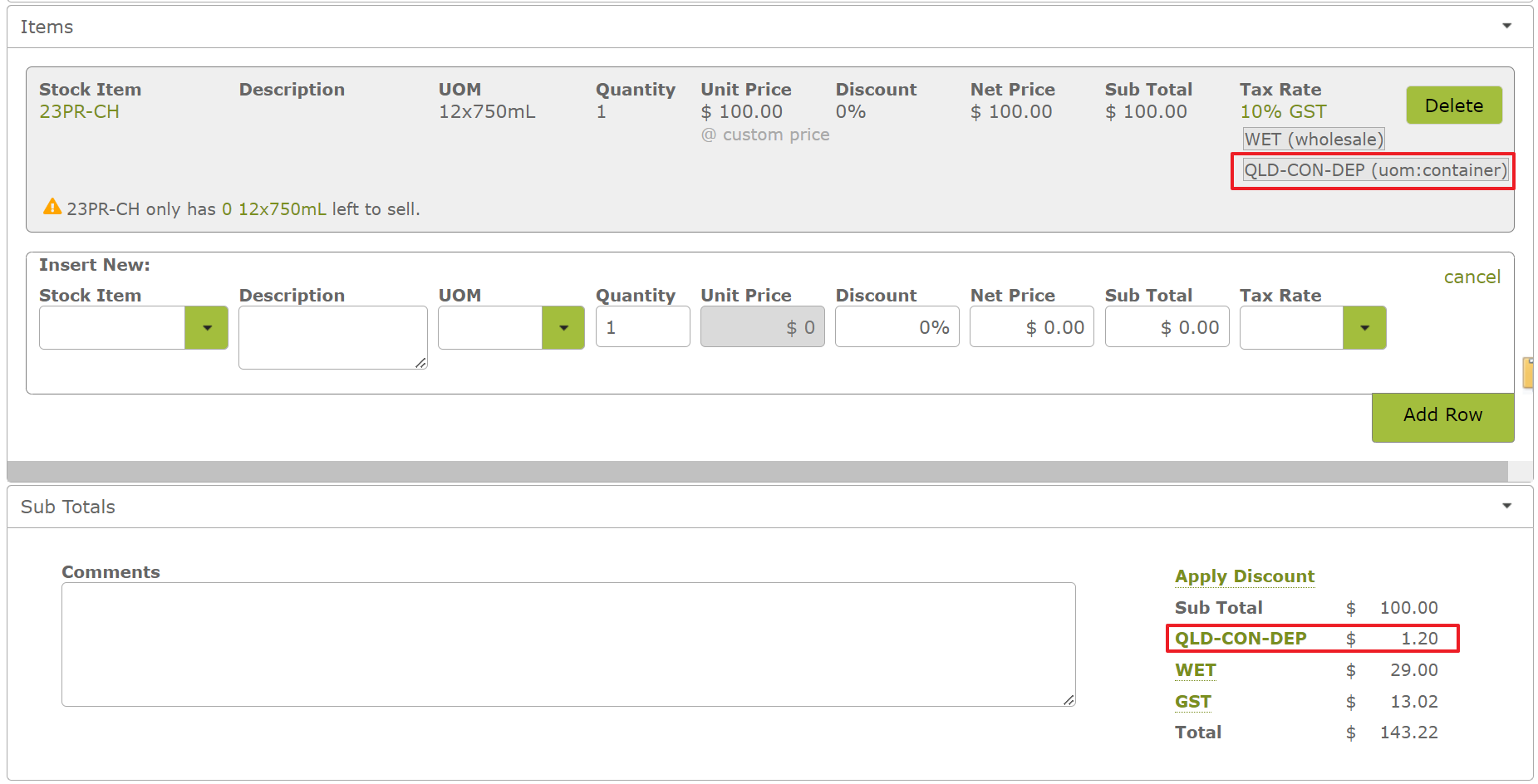

If you have done this correctly, when you raise a Sales Order to a customer that matches the tax criteria, eg they are in QLD, you should see something like this on a Sales Order (the per unit tax in the image below is $0.10, not $0.139):

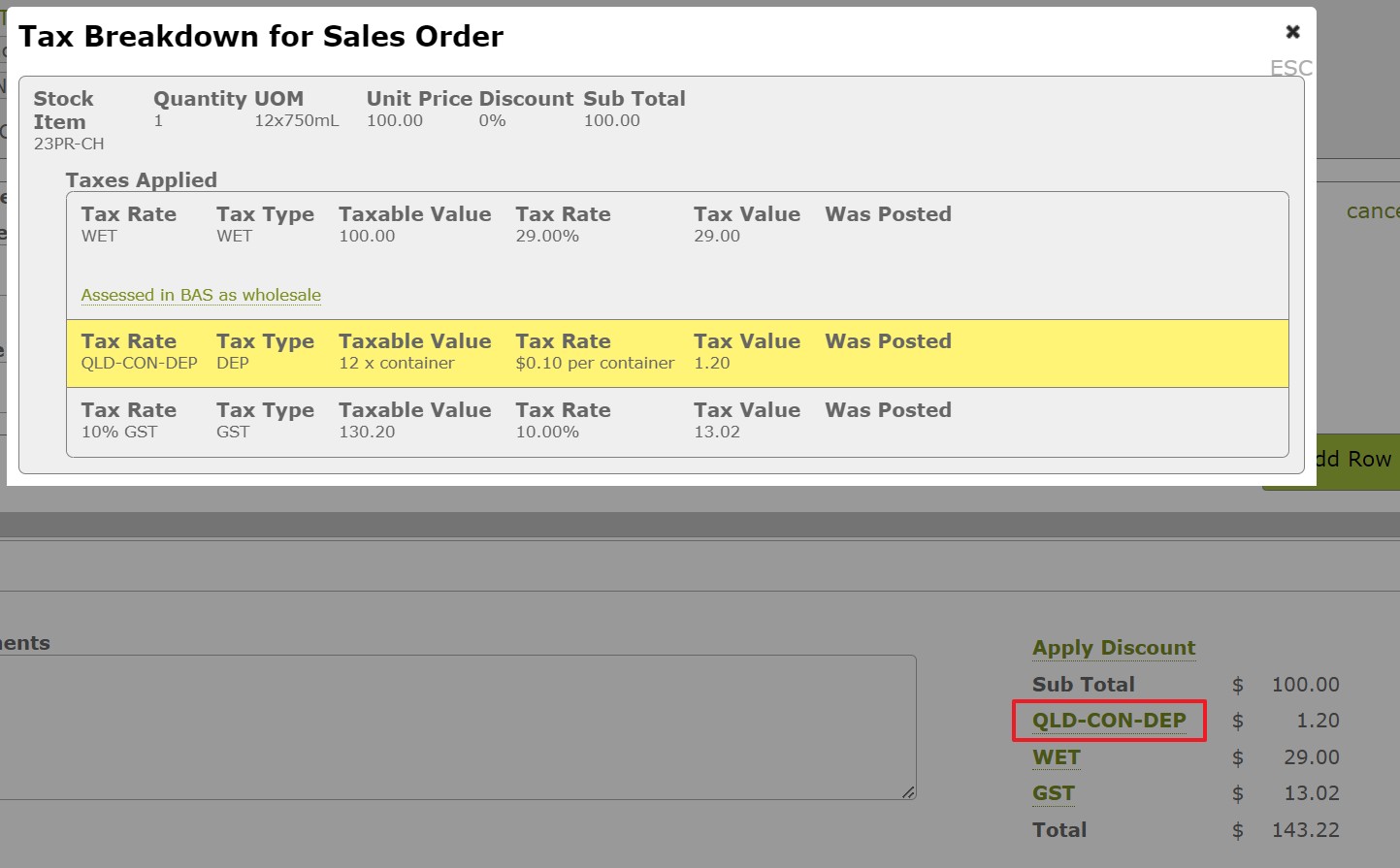

You can click the tax summary lines to see a summary of the calculations (the per unit tax in the image below is $0.10, not $0.139):

Alcohol Taxes Example

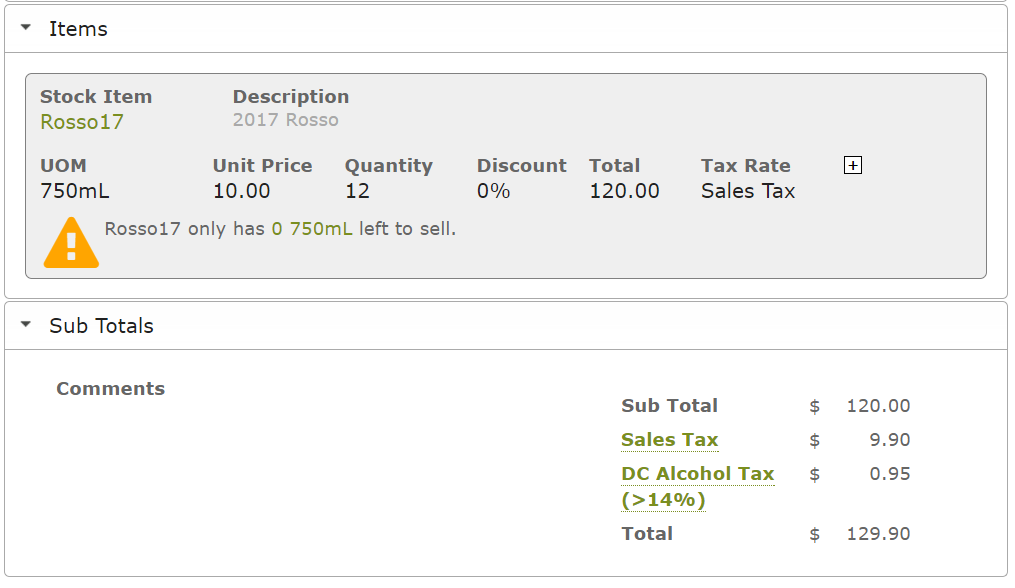

This will give you the ability to create invoices like this:

Where, as well as the usual sales tax based on a percentage of the value of each line item, there are other taxes that might be based per gallon, litre or unit that are also applied.

Setup

To set this up:

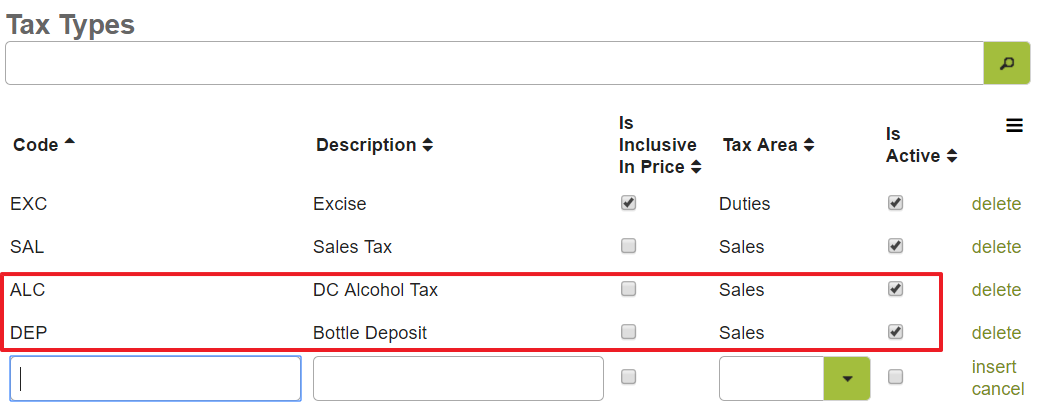

1. Create a Tax Type to represent the class of taxes that each rate falls into, 2 examples here:

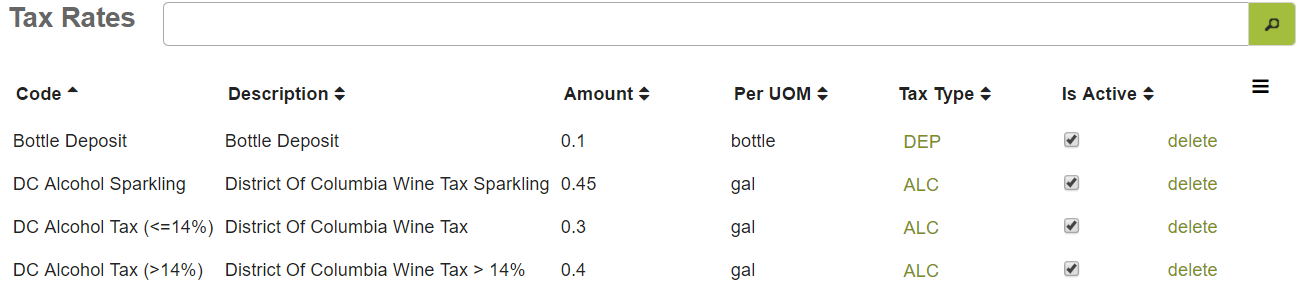

2. Create a Tax Rate for each different tax level you need and set the unit of measure and the amount of tax per unit

eg: $0.10 per bottle for a bottle deposit or $0.45 per gallon for sparking wine.

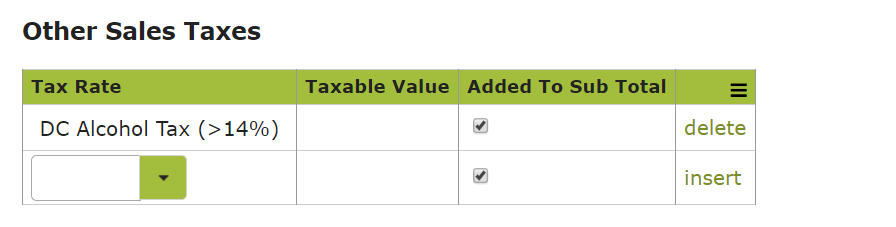

3. Edit each Stock Item and in the Sales, Purchases and Taxes area, add the appropriate Tax Rate:

4. Also ensure that you setup the correct conversion rate back to the taxation unit so the tax will be calculated correctly eg bottle or gallon (gal) in the Conversions Rates area:

Finally do a test sales order to check that everything works as expected and you get something like the image below:

Separate Tax Account in Xero

In relation to the Container Deposit Scheme, if you want to collect money in a separate tax account in Xero, here we have some useful tips on how to so:

1. Setup a “Current Liability” account in Xero:

eg: “822 Deposit Scheme”

2. In Vinsight go to Addons> Setup> Xero and click your Settings area

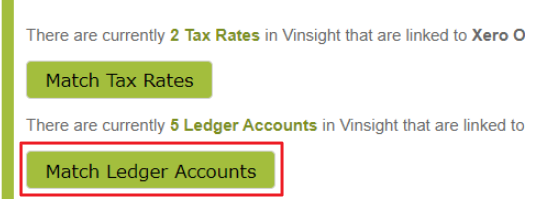

Click the “Match Ledger Accounts” button as per below:

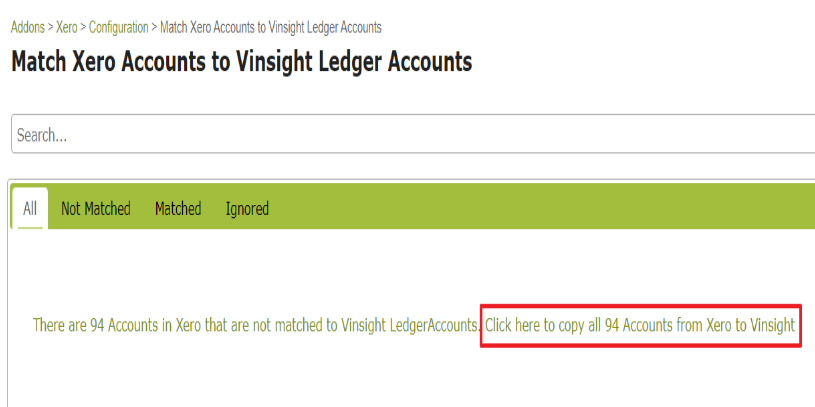

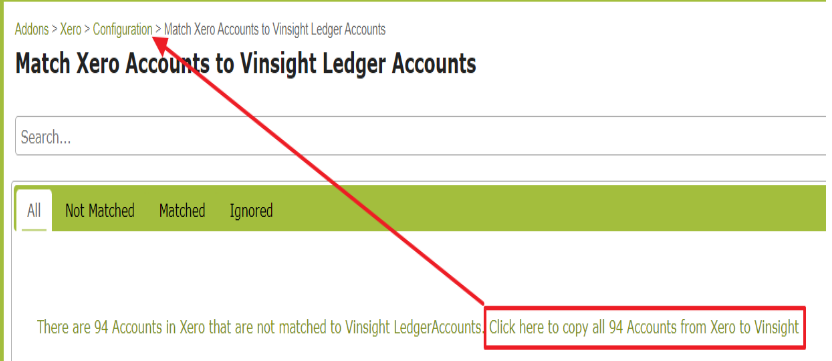

Then, click the link to copy all the new/missing accounts from Xero to Vinsight

Once that completes, go back to “Configuration”:

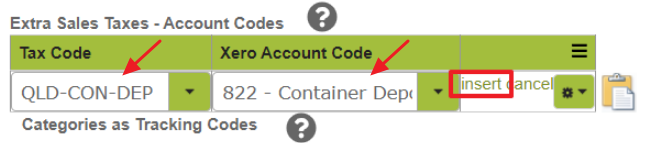

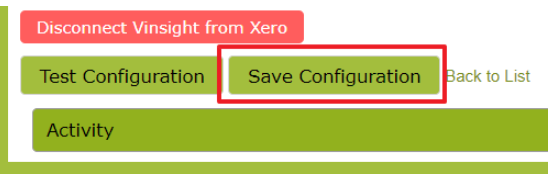

Select the Deposit Tax Code and the Xero Account Code in the “Extra Sales Taxes- Account Codes” area, finally remember to click “insert” AND “Save Configuration” to save your changes.

Now when you post an invoice to Xero, the deposit will go to a separate account so you can easily pay that at the end of the month.

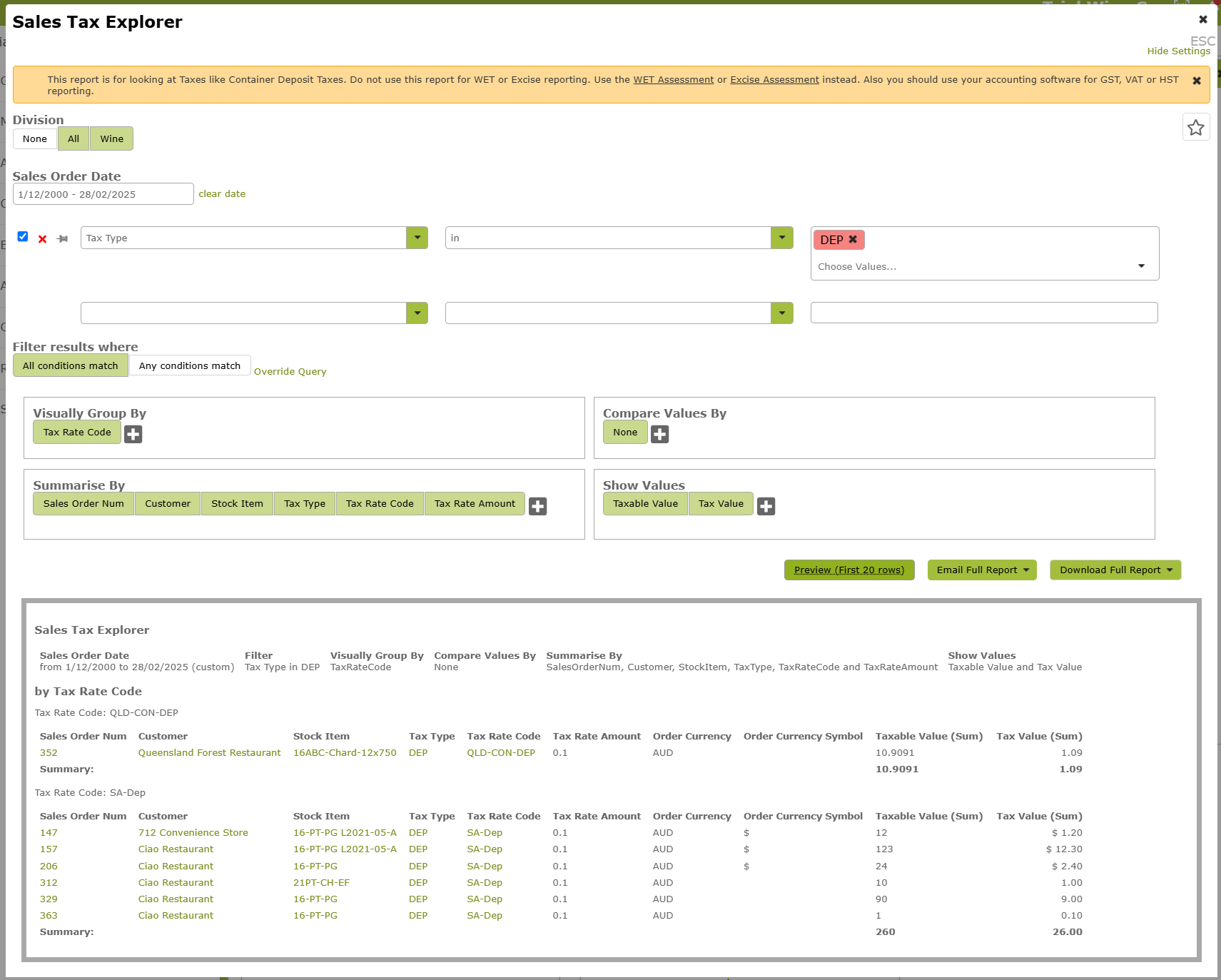

Sales Tax Explorer Report

If You can report on the taxes that you have created and collected above using the Sales Tax Explorer Report in the Reports > Accounts > Sales Tax Explorer.

NB: Do not use this feature for Excise Duty or Wine Equalisation Tax (WET) as there are dedicated features and reporting for these, see Excise Duty Assessments and Calculating WET Tax with Vinsight.

Here is an example report to see the Quantity (Taxable Value) and the Amount (Tax Value) for 2 different taxes collected, you can see in the second tax “SA-DEP” 260 containers collecting $26.00 of tax.