Wholesale Liquor Reporting / Liquor Return Addon

Overview

Vinsight can help you meet liquor sales reporting requirements under state jurisdiction (Australia). Below is a quick summary of requirements as of 2025.

Disclaimer:

The following information is provided for general informational purposes only and is not intended as legal or compliance advice. Regulatory requirements may change, and interpretations may vary. You are solely responsible for ensuring that any alcohol reporting complies with current legislation in your jurisdiction. Vinsight is not liable for any loss or consequences resulting from the use of this information.

| Category | Queensland (QLD) | Northern Territory (NT) | Western Australia (WA) | Tasmania (TAS) |

|---|---|---|---|---|

| Periodic Wholesale Reporting Required? | Yes | Yes | Yes | No, but may be notified |

| Frequency / Format | Annual return due 31 July (online form) | Quarterly report; due 28 days post-quarter | Annual return due 31 July (online) | Annual report (1 Jul–30 Sep); form + CSV |

| Volume Format | Total Litres Alcohol & sales revenue | Yes – Categorised by ABV tier; volume required | Yes – ABV or total LAL required | Yes – Volumes in litres & dollar value |

| Reporting Categories | Beer, Wine, Spirits, RTDs, Cider |

Beer (Low <=3.00%, Mid 3.01–3.99%, Full >=4.00%) Wine (Bottled, Cask, Fortified >=15%) Spirits (≥15%), RTDs, Cider |

Beer (Low ≤3.5%, High >3.5%) Wine (Low ≤3.5%, High >3.5%) Spirits, Cider, RTDs |

Beer (Low <3.0%, Med 3.0–3.5%, High >3.5%) Wine, Fortified, Spirits (>10%), Cider, RTDs |

| Notes | Required under Liquor & Wine Acts | Wholesalers only; retailers exempt | Used to track consumption trends | Exemptions for small volume sellers; penalties apply |

| Further Reading | QLD Annual Return Guide | NT Wholesaler Sales Reports | WA Liquor Returns |

TAS Liquor Licensing TAS Reporting Fact Sheet (PDF) |

In this document:

Pluggin Overview, Enabling State Liquor Reporting Plugin, and Setting License Category:

The State Liquor Reporting Plugin has been created to help extract sales data for meeting state reporting requirements. Reports generated by the plugin are completely achievable using categories and filters in Vinsight’ s reporting suite, steps to do so are illustrated below.

The State liquor Reporting Plugin can be found from our plugins page

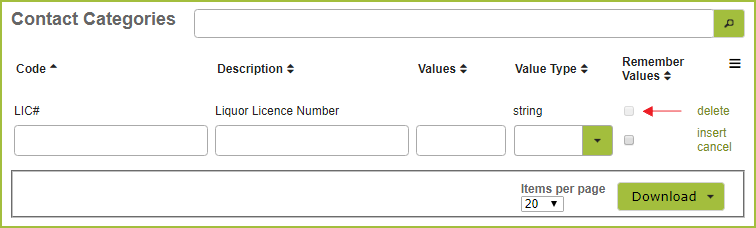

Setting up a Licence Number Category:

You will likely already have created a liquor licence number product category to record customer’s licence numbers under. Enter that category here to ensure the generated reports can reference each contacts license. If not, select no and the contact category “LICNO” will be created for you. You will then need to use this to enter to enter your customer’s liquor licence numbers.

Otherwise, you could go to Contact Categories in the Settings area of People and Companies (Contacts) and create a different license number category and add it above. Un-tick the “Remember Values” tick box so you are not restricted to any options listed there.

Updating your customers’ details:

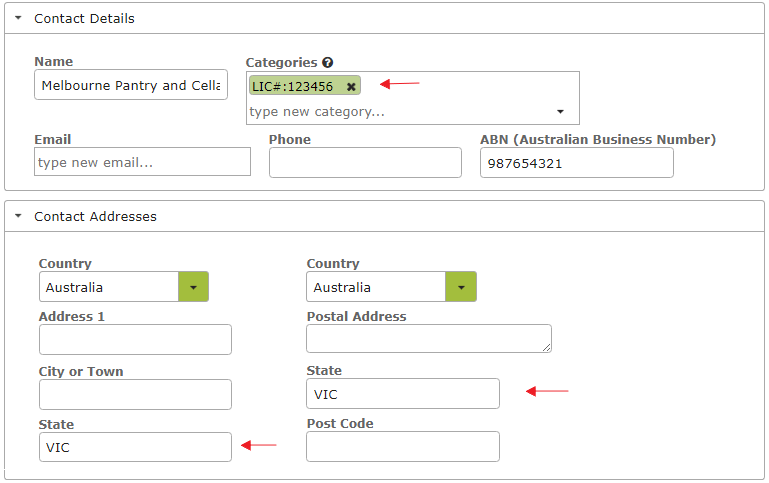

This addon requires that wholesale customers must have a; have a license number listed under your recorded license category from above eg: LIC#:123456 and b); have a state category set, e.g.: State “VIC”

Set Up Product Categories

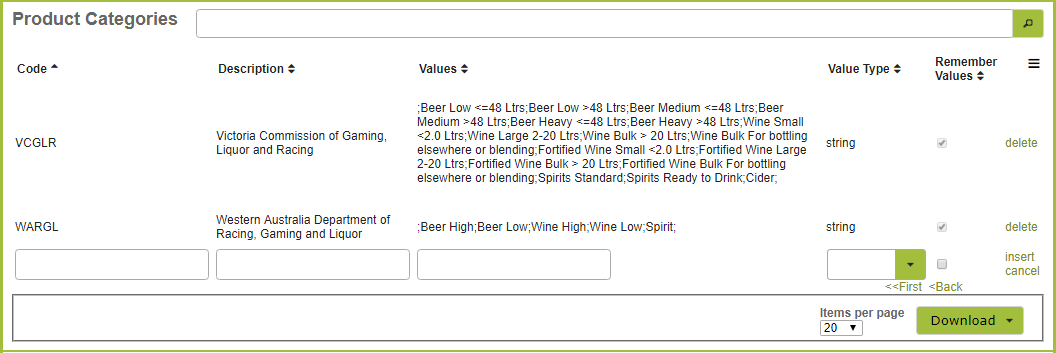

By following the prompts in the addon, it will create you product categories to add to stock items for reporting. However, if you would like to change or add new categories, then this can be

found in the settings area of Inventory (Count) under “Product categories”. In the ‘Values’ area, list all the categories required by that State, separated by semicolons (;) as in the example below.

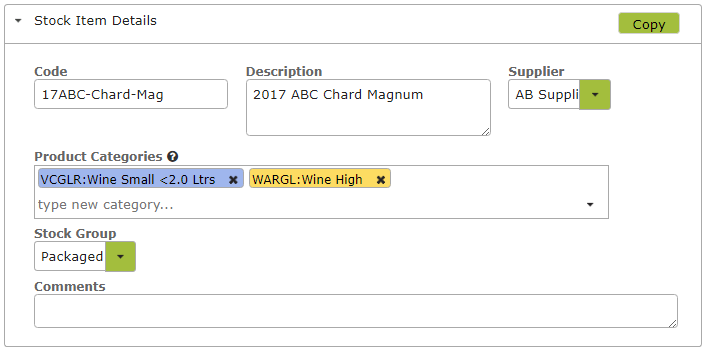

Add Categories to Stock Items

Add the relevant product categories to each Stock Item that you sell into that State. In the following example we are setting up the 17 ABC Chardonnay Magnum for sale to retailers in Victoria and Western Australia.

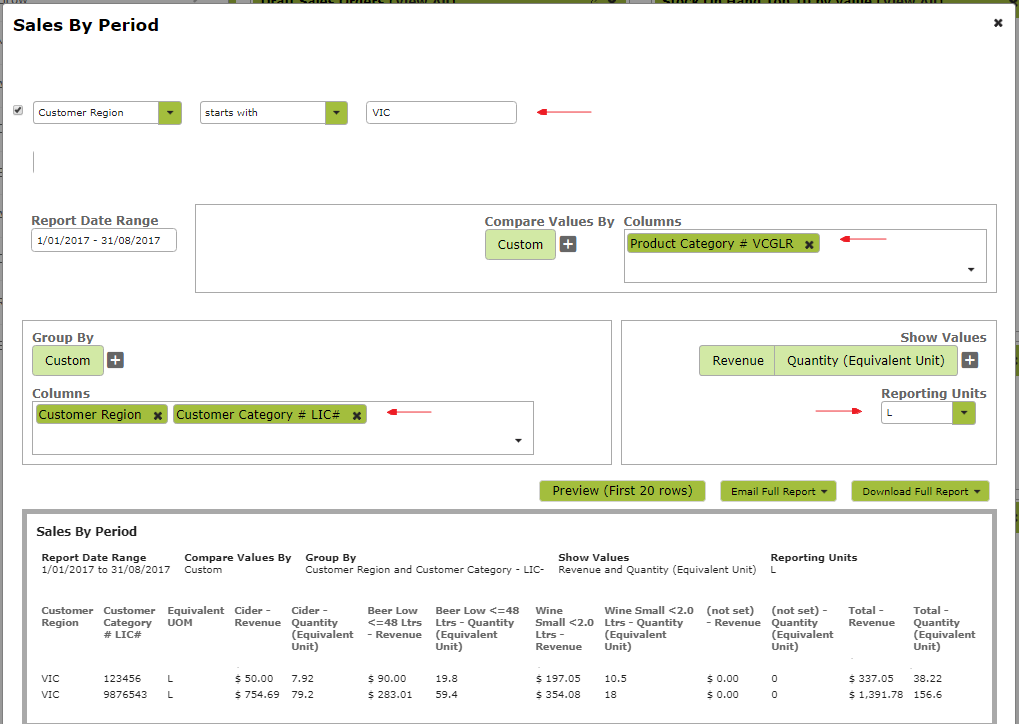

Create Report:

Now you should be able to run the Sales By Period Reports to highlight the sales you are interested in. You can do this either by pressing pressing the create report button on the addon page, or by following the following steps . Set ‘Reporting Units’ to convert sales to litres or any other common unit. Use ‘Custom’ Grouping to group by and display the Customer’s Licence Number. You can download this report to a spreadsheet to manipulate it further and ensure it is in the format required by the particular State.

Click on the sales report below to view larger image.