Non-Sale Product Movements

Overview:

Not all wine movements result from sales. There are many other movements such as ‘samples’, ‘wine pours’, ‘gifts’, ‘donations’, and ‘damaged goods’ which you will need to track for inventory and excise tax purposes.

In this document:

Setting Non-Sale Codes

General

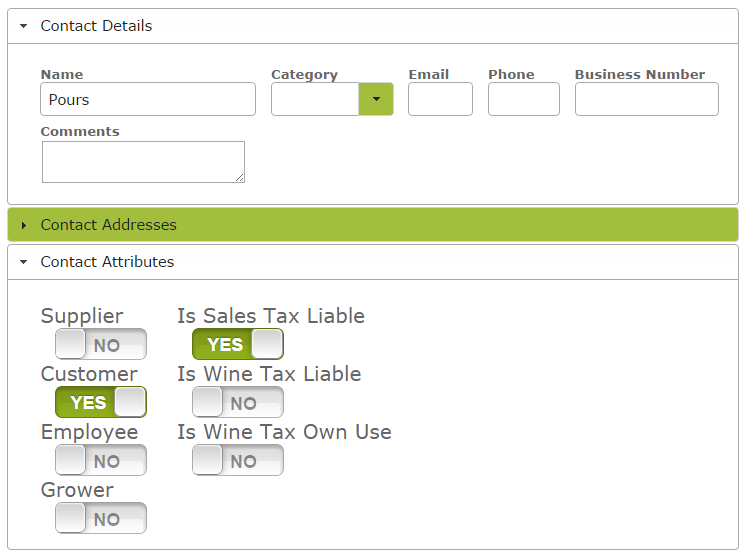

To track non-sale wine movements, you first need to set up codes for such movements in the App. To do this go to the ‘Contacts’ page in the ‘People and Companies’ tab. Create a new contact for each required category. Simply enter a name, such as ‘Samples’ in the ‘Name’ textbox in the ‘Contact Details’ area. In the ‘Contact Attributes’ area, mark the new contact as a ‘Customer’ and indicate whether the movement is of a kind that attracts excise tax, by setting the ‘Is Wine Tax Liable’ attribute to ‘yes’ or ‘no’.

For example for ‘wine pours’, you would name the contact ‘Pours’ or ‘Tastings” or something similar and set the attributes so that it is a customer and is not wine tax liable. A ‘Contact’ for ‘Samples’, ‘Damages’, ‘Donations’ and ‘Gifts’ should be set up in a similar way, ensuring, of course that the ‘Is Wine Tax Liable’ and ‘Is Sales Tax Liable’ switch is set on, for all transactions that would attract this tax in your jurisdiction. For some of these categories like ‘samples’ you might need to flag the contact as ‘wine tax own use’ so the system knows to find a reasonable non-zero taxable value at the end of the period.

Creating a Non-Sale Stock Movement

Samples/Donations/Gifts/Pours

Samples, donations, gifts and pours would be dealt with in a similar way, namely by creating a $0.00 Sales Order and corresponding Despatch Note.

Simply create a new sales order. Select ‘Donations’, ‘Gifts’ or ‘Pours’ as the ‘Customer Name’, enter the details of the wine in the Items area remembering to set the price to ‘0.00’. After saving the Sales Order, select ‘Pick for Despatch’ and create a corresponding Despatch note, remembering to enter the location where the damaged case was stored. Finally ‘Save’ and ‘Update’ the Despatch note.

Damaged Goods

In fact if you are crediting a customer to allow for damaged or spoiled goods, you would write a credit note as above, but then once you have processed this despatch, the inventory will have been returned, therefore increasing your inventory count, so you may wish to “sell” the inventory back out to an account like “breakages” or similar to correct your inventory levels. If your goods are Excise Liable, it may be worth considering which location you return these goods to in order to remain compliant.